Key Developments in USDC Treasury's Recent Mint

The USDC Treasury minted $250 million USDC on the Solana chain on November 14, 2025, an event that was recorded by Whale Alert at 23:16 Beijing time. This transaction signifies potential institutional liquidity moves, impacting DeFi activities and market dynamics on Solana. The mint occurred without official commentary from Circle or Solana leadership.

Impact on Solana's Decentralized Finance

This $250 million USDC mint on Solana has significant implications for the ecosystem, potentially elevating its decentralized finance (DeFi) metrics such as Total Value Locked (TVL). This injection of liquidity could stimulate additional participation in DeFi activities and swaps, indicative of the growing trust in the Solana network for hosting substantial financial operations. While the mint directly impacts Solana's DeFi landscape, it does not directly affect cross-assets like Bitcoin and Ethereum.

Market observers have noted the absence of immediate comments from prominent figures like Jeremy Allaire, CEO of Circle. Historically, Jeremy Allaire has stated that "Large scale USDC mints reflect institutional demand and trust in a regulated, transparent dollar digital asset." While this statement is not directly linked to the current event, it provides context for the significance of such mints.

Informal market feedback suggests that these mints are viewed positively, although some skepticism persists regarding the transparency of real-time communications surrounding such events from Circle.

Historical Context of USDC Minting and Solana's Growth

Historically, consistent large-scale USDC mints on Solana have often aligned with DeFi surges and have sometimes preceded notable shifts in Solana's TVL. These events have contributed to strengthening Solana's position in the Layer-1 blockchain hierarchy.

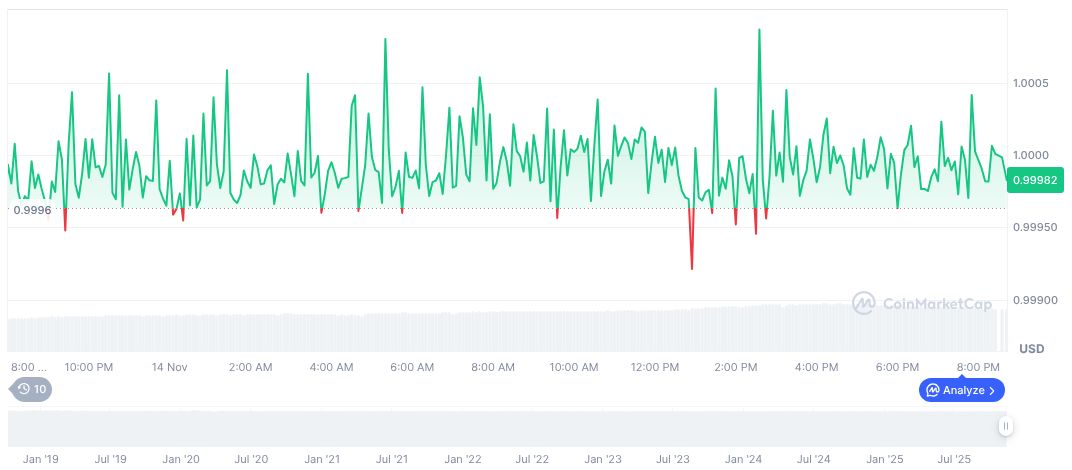

As of Q4 2025, USDC maintains a stable valuation of $1.00, with a market capitalization of $75.22 billion, representing a 2.33% market dominance. The token's 24-hour trading volume reached $23.41 billion, marking a 24.15% increase. Recent price movements have been minimal, which is characteristic of stablecoins designed to resist volatility.

Experts suggest that this recent mint highlights a potential expansion of stablecoin-backed liquidity pools, further strengthening Solana’s DeFi landscape. As regulatory frameworks evolve around stablecoin issuance, USDC continues to play a pivotal role in illustrating the adjustments within digital finance, largely due to its transparent minting processes that foster user trust.