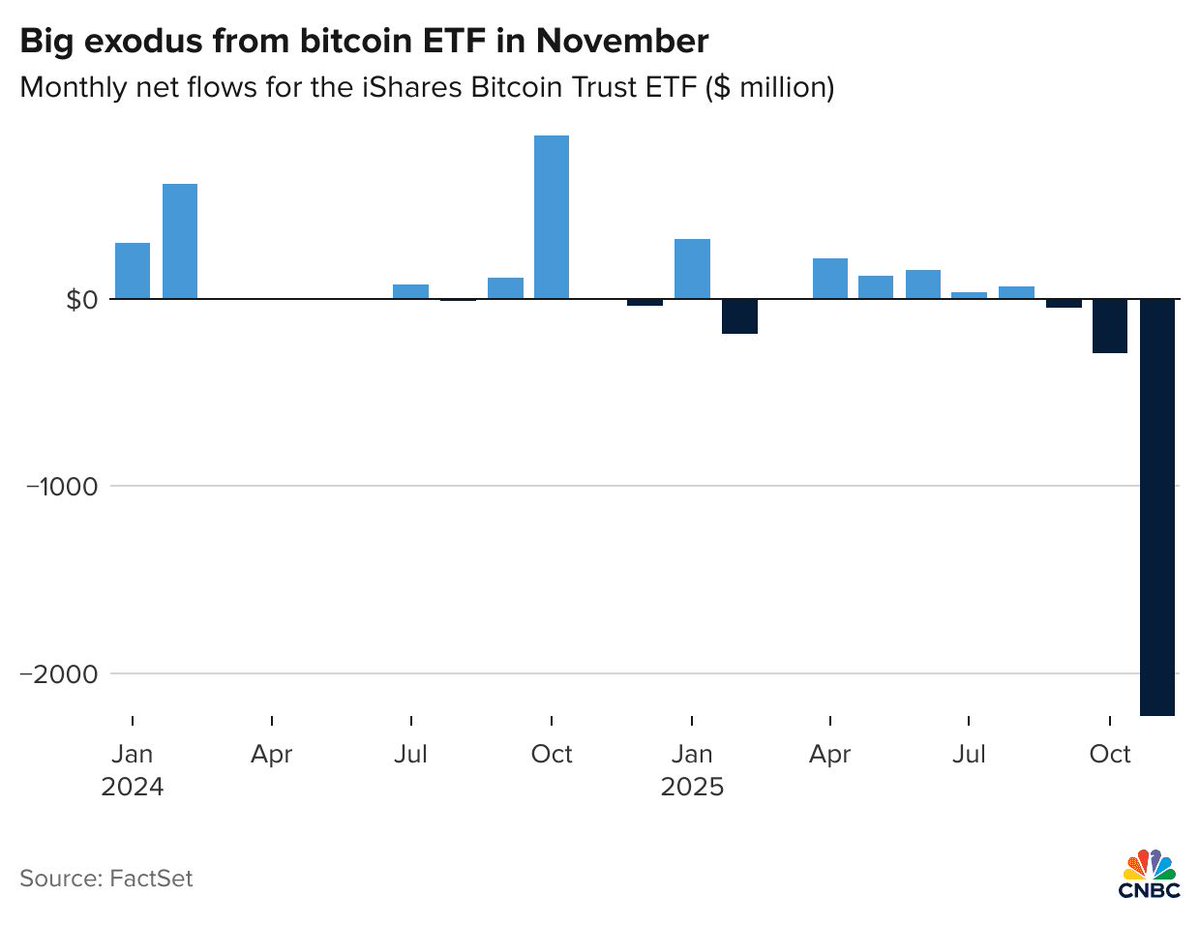

BlackRock’s iShares Bitcoin Trust (IBIT) has recorded its largest monthly outflow since its launch, with a total of $2.2 billion exiting the product in November. This represents a dramatic reversal compared to earlier months which saw steady inflows, signaling a significant shift in investor behavior as the year concludes.

Following a period of consistent growth throughout early and mid-2024, including several months of strong inflows, IBIT's momentum began to wane as the year progressed. October already indicated weakening demand, but November's figure marks a sharp escalation. This is the first time outflows have surpassed the billion-dollar mark, and by a considerable margin.

The accompanying chart also highlights that earlier dips experienced this year were minor when compared to the current exodus. Small outflows recorded during the spring and summer now appear insignificant against November's substantial plunge, which stands considerably below all other data points on the timeline.

Market observers suggest that such a heavy redemption wave often reflects a combination of profit-taking strategies, macroeconomic caution, and shifting risk sentiment among investors. Regardless of the specific reasons, the data confirms that November has become a defining month for IBIT, breaking from nearly two years of overall growth and marking its most aggressive pullback since its inception.

With only one month remaining in the year, attention is now focused on whether BlackRock’s flagship Bitcoin ETF can stabilize, or if November's record withdrawal signifies the beginning of a broader trend.