Ethereum (ETH) has recently dipped below the $3,800 mark. However, several indicators suggest that a significant price rebound could be on the horizon. One notable factor contributing to this potential upturn is the observed decrease in the amount of ETH held on cryptocurrency exchanges.

Conversely, some market analysts have cautioned that Ethereum might be facing the possibility of a more substantial price pullback in the short term.

Shifting to Self-Custody

Renowned analyst Ali Martinez, posting on X, revealed that approximately 200,000 ETH have been withdrawn from cryptocurrency exchanges within the past 48 hours. This significant outflow represents a USD equivalent of around $770 million, calculated at current market rates. This development strongly suggests that investors are increasingly moving their holdings away from centralized platforms and into self-custody wallets, which inherently reduces immediate selling pressure on the market.

Earlier in the week, the total amount of ETH stored on crypto exchanges had fallen to a nine-year low, hovering around 15.8 million coins. The current figures remain quite close to this historical low.

It is important to note a clarification provided by Martinez regarding this trend. He recently stated that approximately 230,000 ETH tokens were moved by large holders, potentially including exchanges, over the past week. This particular movement might encompass a variety of operations such as withdrawals, deposits, and internal transfers, distinguishing it from the broader trend of direct investor withdrawals into self-custody.

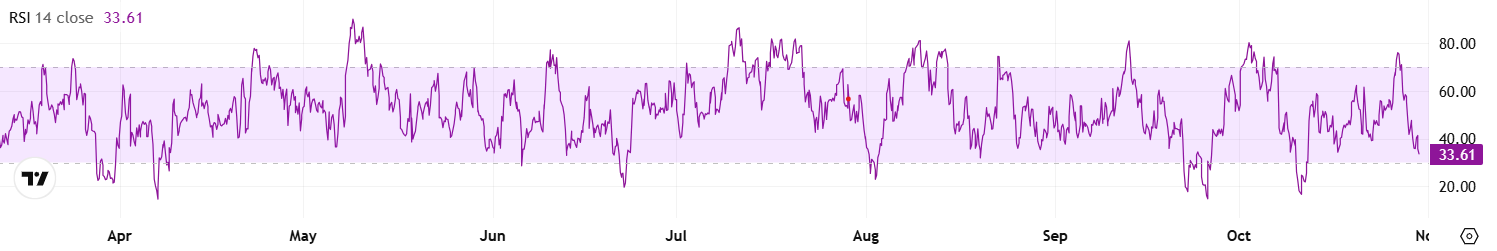

In a separate technical analysis, Ethereum’s Relative Strength Index (RSI) is currently positioned on the bullish side. This technical indicator, which measures the speed and magnitude of recent price changes, is trading just above 30. This level places ETH close to the oversold territory, often signaling potential for a price surge. Conversely, RSI values above 70 are typically interpreted as an overbought condition, suggesting potential bearish pressure on the price.

Critical Juncture for ETH

As of the latest reporting, Ethereum is trading at approximately $3,800, marking a 5% decrease on a daily basis and an 8% decline over the past month. X user Ted noted that the drop below $4,000 occurred following the US Federal Reserve's decision to lower interest rates and amidst ongoing US-China trade talks. He opined that this situation could represent either a "classic bear trap" or indicate that the crypto market is heading for significantly lower prices. Kamran Asghar contributed to the discussion, envisioning a potential dip to the $3,400-$3,500 range before a renewed rally could commence.

In contrast, other analysts hold a more optimistic outlook. Max Crypto, for instance, is predicting an "up-only" scenario where ETH could surge to a new all-time high of $7,000. According to this analyst, Ethereum's recent price action closely resembles the conditions observed before a substantial surge in May of this year.

Furthermore, whales with a documented 100% winning rate have recently initiated long positions in ETH, fueling speculation that they may possess insider knowledge or insights into future price movements.