Market Volatility and Bitcoin's Downturn

Bitcoin's recent slide below $105,000 has intensified concerns about a potential market correction, wiping out nearly all the gains achieved since the rebound following the October 10 liquidation event. During early U.S. trading hours, the cryptocurrency briefly dropped to $103K, representing a 2.85% intraday decrease and a 6.3% weekly decline, marking its most significant pullback in approximately a month.

Altcoins experienced even sharper declines. Ethereum ($ETH) fell below $3.5K. Simultaneously, Solana ($SOL), Binance Coin ($BNB), and Dogecoin ($DOGE) each dropped by over 10% from their weekly opening prices as traders divested from risk assets amidst escalating volatility.

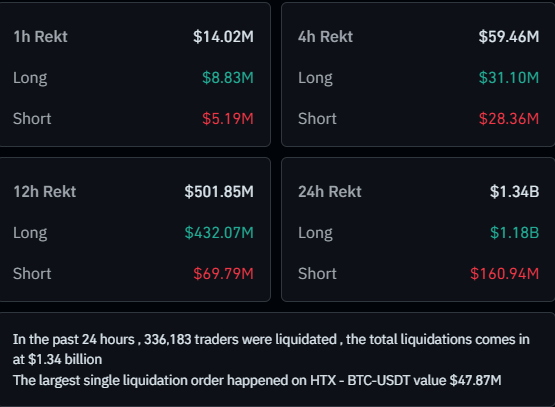

The sell-off significantly impacted the crypto derivatives market, leading to over $1.3 billion in liquidations within the past 24 hours, with long positions accounting for $1.18 billion of that total.

Despite consolidating around the $110K level for several weeks, Bitcoin's abrupt correction highlights the sensitivity of altcoin traders to shifts in macroeconomic sentiment.

Traditional Market Performance and Crypto Equities

Traditional markets presented a mixed performance. U.S. equities opened higher on Monday, driven by renewed optimism surrounding artificial intelligence, but this initial momentum waned. The Nasdaq and S&P 500 ultimately closed the session with modest gains of 0.3% and 0.07%, respectively, gains that masked underlying volatility.

Crypto-exposed equities mirrored this turbulence. Coinbase (COIN) and Marathon Digital (MARA) each fell by over 4%, MicroStrategy (MSTR) dropped by 3%, and Circle (CRCL), whose stock has faced pressure due to declining stablecoin volumes, tumbled by more than 7%.

Long-Term Bullish Outlook Amidst Volatility

Despite the current market backdrop, FundStrat's Tom Lee maintains an optimistic stance, predicting that Bitcoin could reach $200,000 by year-end. He attributes this potential growth primarily to institutional accumulation and strengthening fundamental indicators.

As institutional investors quietly acquire assets during the dip, retail investors are shifting their focus to emerging opportunities, particularly Bitcoin Hyper ($HYPER). Bitcoin Hyper is an emerging Layer-2 solution designed to support Bitcoin's next significant upward movement.

Bitcoin Hyper ($HYPER): The Layer-2 Solution for Bitcoin's Next Rally

While Bitcoin's long-term prospects remain robust, its underlying technology continues to face challenges in keeping pace with the demands of the contemporary blockchain era. Bitcoin Hyper ($HYPER) aims to address these limitations.

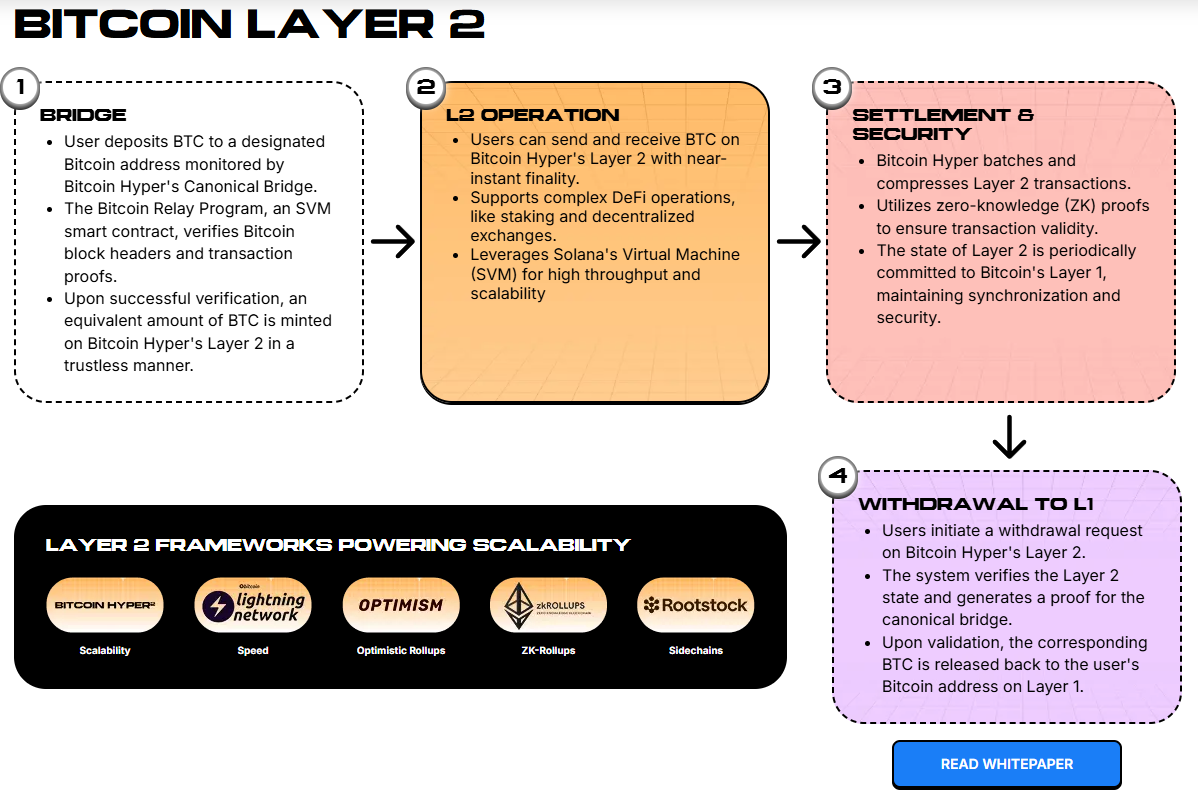

Developed as a next-generation Layer-2 network, Bitcoin Hyper ($HYPER) seeks to introduce scalability, programmability, and near-instant settlement to the Bitcoin ecosystem, all while preserving Bitcoin's foundational principles of decentralization and security.

At its core, Bitcoin Hyper integrates zero-knowledge (ZK) rollups, which facilitate efficient transaction batching and cost reduction, with the Solana Virtual Machine (SVM). The SVM enables high-speed, parallel execution of smart contracts.

This hybrid architecture effectively bridges Bitcoin's established security model with Solana's performance-oriented framework.

Collectively, these technologies empower decentralized finance (DeFi) protocols, tokenized assets, and real-world applications to operate directly on the Bitcoin network, unlocking use cases previously beyond its technical capabilities.

Similar to how Arbitrum, Optimism, and Base enhanced Ethereum's scalability, $HYPER has the potential to transform Bitcoin into a programmable financial layer, capable of supporting a vast ecosystem of decentralized applications and tokenized value.

Given that market veterans like Tom Lee and Michael Saylor maintain their long-term bullish outlook on Bitcoin, infrastructure projects like $HYPER are well-positioned to benefit from a multiplier effect when the next significant bull phase commences.

$HYPER Presale: Staking, Investor Conviction, and Opportunity

Despite the current market turbulence, the Bitcoin Hyper ($HYPER) presale continues to demonstrate remarkable momentum. The project's presale has now raised over $25.7 million, with tokens currently priced at $0.013215 each. This performance positions $HYPER as one of the most successful early-stage launches of 2025, driven by more than just hype.

Over $14 million worth of $HYPER is currently being staked, yielding up to 46% APY. This indicates strong investor conviction, even as the broader cryptocurrency market navigates a correction.

Bitcoin Hyper's accelerating traction reflects a growing sentiment that Bitcoin's next major growth cycle will be fueled not only by price speculation but also by infrastructure innovation built directly on its base layer.

As Bitcoin stabilizes and institutional interest rebuilds, retail participants are positioning themselves for what many perceive as the next asymmetric opportunity, gaining exposure to Bitcoin's technological evolution through $HYPER.