Fintech expansion: VAS and Capitec connect

Capitec’s fintech division, comprising Value‑Added Services (VAS) and Capitec Connect, contributed R2.1 billion ($122.180 m) to group headline earnings, up from R1.5 billion ($87.299 m) in 2024.

Net income from VAS grew by 36 % to R2.7 billion (2024: R2.0 billion). The number of clients using VAS increased to 11.8 million from 10.7 million in 2024, while transaction volumes rose to 845 million, compared to 704 million.

The bank’s send cash service saw rapid uptake. The number of clients using the feature increased to 5.4 million from 1.2 million in 2024, with income rising 56 % to R685 million ($39.865 m).

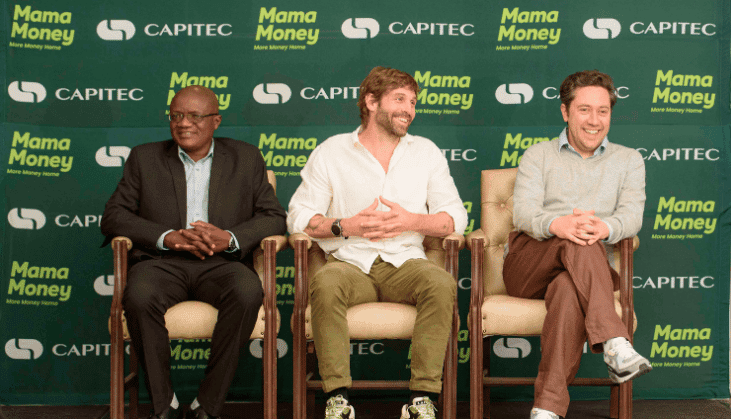

In August 2025, Capitec launched a cross‑border money transfer product in collaboration with MamaMoney. Early adoption figures show 3,888 clients already making use of the service to send funds to countries including Zimbabwe, Malawi, Mozambique, Kenya, Tanzania, Uganda, Zambia, and Lesotho.

VAS expansion also included the August 2025 launch of airtime advances, allowing clients to purchase airtime on networks beyond Capitec Connect when balances are insufficient. Vehicle licence renewals, another VAS product, reached 46,220, pushing the bank’s market share to 17.6 %, compared to 15 % in 2024.

Capitec Connect, the bank’s mobile connectivity service, also delivered strong growth. Net income rose to R165 million ($9.601 m) from R69 million ($4.015 m) in 2024.

Active users in the last three months reached 1.1 million, up from 0.6 million, while data usage surged by over 100 % to 14.9 petabytes from 5.1 petabytes. Voice usage also more than tripled to 311 million minutes compared to 95 million in 2024. Since 1 March 2025, Capitec has rewarded clients with 449 terabytes of data.

Technology‑enabled product innovation

Capitec continued to leverage technology for product innovation during the period. Its accessible credit card, launched in February 2025, now has limits ranging from R600 to R500,000. More than 64,000 low‑limit cards have been issued, enabling younger clients to begin building credit profiles. Credit card clients also benefit from 1 % cash back on purchases, 1 GB of free Capitec Connect data monthly, and zero forex commission on international card payments.

The bank also rolled out a repay‑as‑you‑earn loan in July 2025, designed for multiple income earners and small and medium‑sized enterprises. The product generated R8.3 million in loan disbursements within its first six weeks. Loans to multiple income earners grew by 81 % to R984 million, while purpose loans reached R1.8 billion compared to R640 million in 2024.

Another notable innovation was the availability of affordable smartphones for purchase directly through the Capitec app. Clients are able to finance these devices via new advances launched during the reporting period, tying smartphone ownership more closely to the banking relationship.

Underlying these product and service innovations was a sharp rise in technology spending. Information technology (IT) expenses increased by 33 % to R1.6 billion, compared to R1.2 billion in 2024. Capitec attributed the higher outlay to accelerated investment in innovation and strategic projects, enabled by its strong financial performance.

This scale of technology investment was reflected in its operating cost base. Group operating expenses grew 16 % to R10.0 billion, of which IT accounted for a material share. The expenditure highlights the bank’s ongoing commitment to expanding its digital ecosystem, enhancing security, and scaling its infrastructure to support growth in app and fintech usage.

Capitec’s half‑year results demonstrate the extent to which technology has become central to its growth strategy. Digital banking adoption is deepening, app usage continues to expand, and global payment integration is broadening its footprint.

The fintech arm, led by VAS and Capitec Connect, is delivering material earnings contributions, while innovations such as cross‑border remittances, airtime advances, and smartphone financing reinforce its role in clients’ daily lives.