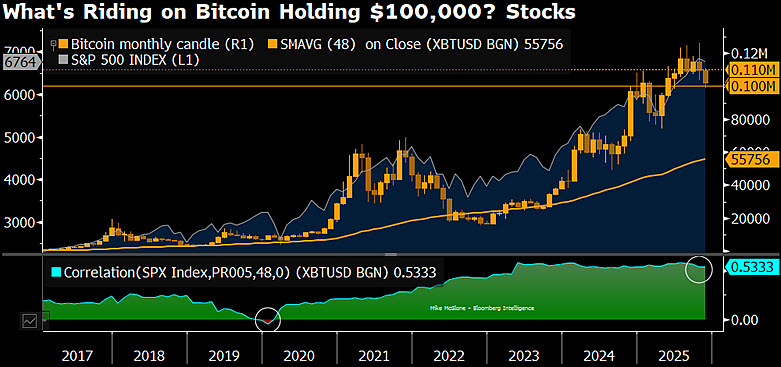

Bloomberg’s senior commodity strategist Mike McGlone has cautioned that Bitcoin’s $100,000 level might not hold for long, describing it as a potential “speed bump toward $56,000” if market conditions continue to revert to historical norms. According to McGlone, the world’s largest cryptocurrency often revisits its 48-month moving average after extended rallies, suggesting that a sharp correction may be part of its cyclical behavior.

Key Takeaways

- •Mean reversion warning: McGlone believes Bitcoin could retest its 48-month moving average near $56,000, mirroring past post-rally pullbacks.

- •Market humility phase: He notes that overextended price moves often “refresh humility,” as markets rebalance after excessive optimism.

- •Stock market correlation: Bitcoin’s current trend remains closely tied to the S&P 500, emphasizing how broader macro sentiment continues to shape crypto direction.

McGlone pointed out that every time Bitcoin stretched far above its long-term moving averages, it eventually corrected back toward them. He referred to the $100,000 region as an “overextended plateau,” suggesting that the current price level could serve more as resistance than a sustainable base.

Using historical comparisons, McGlone highlighted that Bitcoin’s mean reversion, or tendency to return to its long-term trendline, has been consistent after each major cycle. The 48-month moving average, now around $55,756, marks the level that Bitcoin typically gravitates toward after euphoric peaks.

Macro and Liquidity Factors in Play

Beyond technical patterns, McGlone cited broader macroeconomic pressures. With global liquidity tightening and ETF inflows slowing, Bitcoin’s price has shown a growing dependency on risk sentiment in traditional markets.

His analysis indicates that the correlation between Bitcoin and the S&P 500 Index remains at 0.53, underscoring how equity market movements still influence Bitcoin’s trajectory. A downturn in stocks could easily amplify Bitcoin’s correction, while renewed risk appetite could help it regain footing above $100K.

“Humility in Markets” – McGlone’s Message to Bulls

“Look at the chart” has long been a mantra for Bitcoin bulls, but McGlone reminded investors that “market gods can refresh humility when prices stretch too far.” He argues that the current setup is less about panic and more about natural rebalancing after an exuberant phase.

If Bitcoin’s 48-month moving average continues to act as a gravitational pull, the $56,000 region could serve as the next major test of resilience, a level that has historically reignited long-term accumulation once fear peaks.

Market Context

As of November 6, Bitcoin trades around $101,200, down roughly 5% this week. Analysts continue to debate whether this is a healthy consolidation before a new leg up or the start of a deeper retracement toward long-term fair value levels.

Either way, McGlone’s analysis injects a dose of caution into a market still recovering from ETF inflow slowdowns and heightened volatility across altcoins.

Technical Snapshot: Bitcoin Holds the Line at $101K

Bitcoin is currently trading at $101,460, down 2.68% over the past 24 hours and 5% over the past week. The decline extends a broader market pullback but keeps Bitcoin above the critical six-figure threshold that analysts view as short-term support.

Key Levels to Watch:

- •Immediate Support: $100,000 psychological zone

- •Secondary Support: $95,500 (local demand zone)

- •Resistance Levels: $105,000 and $112,000 (previous mid-October highs)

- •Long-Term Average (48-Month MA per McGlone): ~$55,756

Momentum indicators suggest Bitcoin remains in a neutral-to-bearish phase as traders weigh the probability of further mean reversion versus consolidation above $100K. A decisive break below the $100K mark could open a path toward $95K–$90K, while reclaiming $110K would reassert bullish control.