A consortium of ten banks is preparing to launch a euro-pegged stablecoin that will comply with the European Union’s Markets in Crypto-Assets (MiCA) framework. BNP Paribas announced that it would join nine other EU-based banks in launching the stablecoin, which is slated for release in the second half of 2026. The stablecoin will be issued through Qivalis, an entity based in Amsterdam. The planned launch is contingent upon receiving regulatory approval.

🇪🇺 BREAKING: Ten major EU banks are teaming up to launch a euro-pegged stablecoin by 2026, under a Dutch Central Bank–backed entity. Regulatory approval targeted for late 2026. The stablecoin wars are officially here. #EU #Stablecoin #Crypto #Blockchain #ECB

- Bruno Trader (@BrunoTrade87) December 3, 2025

New Euro-Pegged Stablecoin Aims for Autonomy in the Digital Age

Stablecoins are blockchain-based tokens designed to maintain a stable value by being backed by reserves of stable assets, most commonly fiat currencies. The stablecoin market has experienced significant growth in 2025, partly due to a more favorable regulatory environment in the US and increasing exploration of blockchain technology by major corporations.

Jan-Oliver Sell, CEO of Qivalis, stated that the upcoming launch of the euro-pegged stablecoin is intended to provide "monetary autonomy," going beyond mere convenience. He added that the token will offer "new opportunities for European companies and consumers to interact with onchain payments and digital asset markets in their own currency."

ECB Assesses Stablecoins as Low Threat to Europe

The planned launch of the euro stablecoin by EU banks follows an assessment by the European Central Bank (ECB) that stablecoins pose minimal risk to Europe. In a financial stability review published in late November, the ECB attributed this assessment to the low adoption rates of stablecoins and the preemptive regulatory framework established by the EU.

The report, authored by financial stability experts Senne Aerts, Claudia Lambert, and Elisa Reinhold, did, however, emphasize the need for continuous monitoring of the stablecoin market's growth. This assessment contrasts with concerns raised by Dutch Central Bank Governor Olaf Sleijpen, who reportedly warned of potential risks to monetary policy as the stablecoin market expands.

USD Stablecoins Dominate the Market

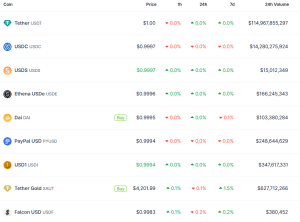

The global stablecoin market capitalization has surpassed $300 billion, currently standing at approximately $311.4 billion, according to data from CoinGecko. USD-pegged tokens represent the largest segment of this market. Tether's USDT, with a market capitalization exceeding $114.9 billion, and Circle's USDC, with a total capitalization over $14.2 billion, are the two leading stablecoins.

Following USD-pegged stablecoins, tokens backed by physical gold are the next most significant category. The largest stablecoin not backed by USD or gold is Circle's EURC, with a current market capitalization of over $28.7 million.

Tether had previously offered a euro-pegged token, EURt, but discontinued redemptions for it on November 25. This decision came approximately one year after the company initially announced its intention to discontinue support for the token. Tether cited the EU's MiCA regulations as the basis for this decision, with CEO Paolo Ardoino expressing that these regulations posed systemic risks for stablecoins.