The cryptocurrency market experienced a painful correction lately, with Bitcoin (BTC), Ethereum (ETH), and many other leading digital assets posting substantial losses.

However, some like Internet Computer (ICP) remain unfazed, charting triple-digit gains over the past week.

ICP's Remarkable Price Surge

ICP currently trades at around $6.12, representing a 27% increase on a daily basis and a staggering 100% surge in the last seven days. Its renewed upward momentum started at the end of October and intensified at the start of the business week.

Back then, the DFINITY Foundation, the creator and main contributor behind the Internet Computer blockchain, launched the AI platform called “Caffeine.” This platform enables users to build applications.

Analyst Sentiment and Price Predictions

The rally has caught the attention of numerous analysts who believe ICP has yet to reach more impressive peaks. X user Captain Faibik argued that the asset has broken a downward trendline with “strong buying volume,” envisioning a pump above $12 in the following months.

CryptoBoss thinks the surge above the $6 mark could trigger a further jump to $15. X user LSD revealed adding ICP to their portfolio, citing several reasons why a full-scale bull run might be on the way:

“ICP is in the late phase of its correction after enduring a long, multi-year bear cycle. The structures [are] tightening up <> classic signs of volatility compression, and the candles are hugging that key EMA zone. A clean weekly reclaim above $6.5+ flips the macro structure bullish and sets the stage for a major trend reversal.”

Other analysts on X predicted that ICP’s valuation could soon exceed $50. This would require the asset’s market cap to surpass $23 billion, which would place it close to the top 10 cryptocurrencies. Currently, ICP is the 46th-biggest digital asset with a capitalization of approximately $3.2 billion.

Potential for a Short-Term Pullback

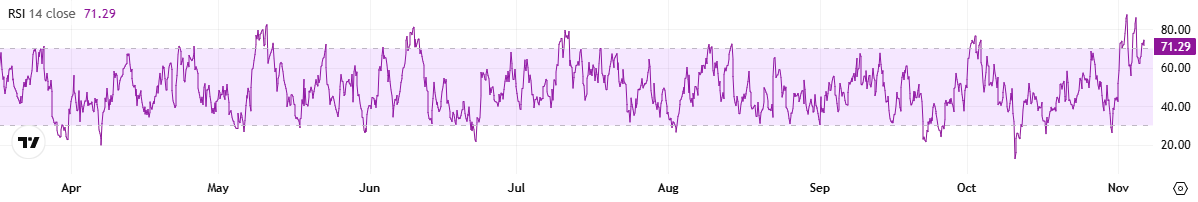

It is worth noting that certain factors suggest that ICP’s uptrend may be halted in the short term. Such an element is the asset’s Relative Strength Index (RSI), which measures the speed and magnitude of the latest price changes.

The RSI varies from 0 to 100. Ratios above 70 signal that ICP could be in overbought territory, hence poised for a correction. Conversely, readings below 30 are considered buying opportunities. As of press time, the RSI stands at around 73.