Grayscale Founder Barry Silbert-Linked Company Sells Holdings in Zcash Trust

Grayscale Investments, a crypto asset management firm, enabled private placement for accredited investors in Zcash Trust a month ago, which sparked a significant rally in ZEC price. A month later, Silbert Family Investments booked profits by selling some shares in Grayscale Zcash Trust (ZCSH). The Barry Silbert-linked firm made substantial gains by selling shares after an eight-year holding period.

According to a US SEC filing, Silbert Family Investments LLC sold 9,753 shares of Grayscale Zcash Trust (ZCSH). These shares were initially purchased by the Barry Silbert-linked firm in October 2017 through a privately negotiated transaction from the issuer for cash. Notably, Silbert Family Investments last sold 1,897 shares of ZCSH on July 25. Canaccord Genuity served as the broker for the family firm's transactions.

In related news, Digital Currency Group (DCG) and DCG International Investments recently sold shares of the Grayscale Solana ETF before its debut last week. As previously reported, DCG sold 387 GSOL shares on October 28 through Canaccord Genuity Corp. The firm had acquired these shares on October 19 of the previous year in a privately negotiated transaction from the issuer for cash. The total shares outstanding for this ETF are 7,231,035. Additionally, DCG International Investments sold 7,100 shares on October 27 and 6,723 shares on October 28, also through Canaccord Genuity Corp.

Arthur Hayes Predicts Zcash Price to Hit $1,000

BitMEX founder Arthur Hayes, in an X post on November 6, shared his new price target for Zcash, predicting $1,000 as the next significant level as ZEC price surpassed $530 on that day. Hayes has been an active proponent of Zcash amidst the growing demand for privacy coins. Previously, he had forecasted a bold $1,000 price target for ZEC, indicating a potential major comeback after seven years.

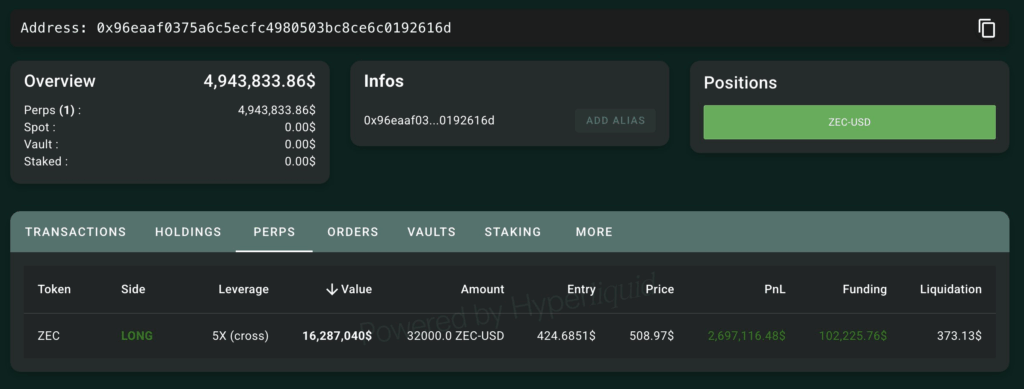

The crypto community and significant holders, often referred to as whales, continue to accumulate the privacy coin despite some institutional profit-taking. Lookonchain reported that a whale had created a new wallet, identified as 0x96ea, three days prior to the report, which had accumulated $2.7 million in unrealized profit.

ZEC Price Jumps Over 20%

The ZEC price saw a significant jump, paring some gains after a 20% surge in the preceding 24 hours. At the time of reporting, the price was trading at $544.28, with a 24-hour low and high recorded at $452.77 and $534.81, respectively.

Furthermore, trading volume increased by nearly 18% in the last 24 hours, indicating strong buying interest despite selling activity from institutions like Silbert Family Investments. Meanwhile, CoinGlass data revealed that substantial buying activity continues in the derivatives market. As of the time of writing, the 24-hour total ZEC futures open interest had climbed nearly 29% to $931.79 million. Additionally, the 4-hour ZEC futures open interest on major exchanges like Binance, OKX, and Bybit saw increases of more than 5%, 64%, and 14%, respectively.