Bitcoin price experienced an unexpected capitulation this week, reversing its minimal weekend gains. This outcome signals that the bears remain in control of the market.

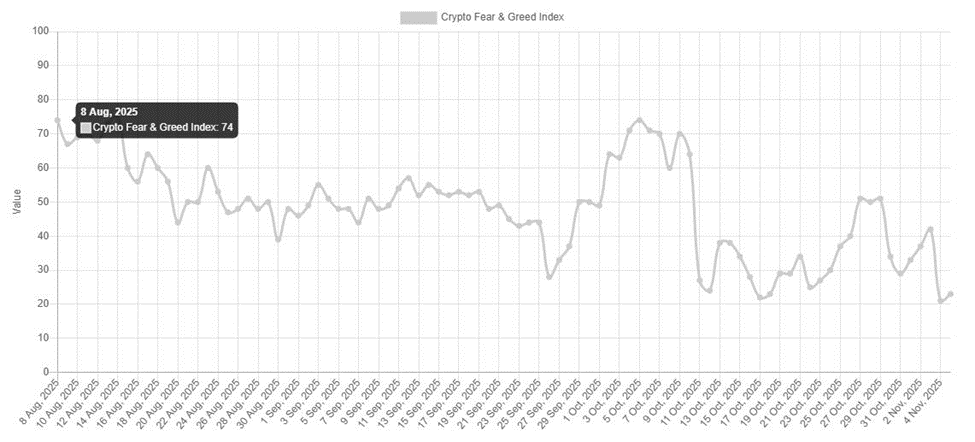

The decline in Bitcoin's price was accompanied by a sharp drop in market sentiment, as measured by the Crypto Fear and Greed Index. The index fell to 21 points on Tuesday, its lowest level since April, indicating extreme fear among investors.

This bearish trend also saw Bitcoin's price fall below the $100,000 mark, a level not retested since June. This further underscores the prevailing negative sentiment, which has dipped below levels observed during the October flash crash.

The bearish price action also coincided with a notable increase in Bitcoin exchange reserves. Reserves rose from 2.386 million BTC on Monday to 2.393 million BTC at the time of observation.

Bitcoin Price Risks Further Downside

The $100,000 price level has historically served as a critical support, underpinning bullish resilience. A sustained break below this level suggests a decline in bullish confidence.

Bitcoin price dipped below $99,000 but has since recovered to above $104,000, following a bounce near $98,000. This recovery indicates that significant accumulation occurred at the support level.

However, recent recovery attempts have shown weak demand, particularly from whales. If demand fails to strengthen significantly, Bitcoin may face further downside pressure.

In the event of continued demand weakness, the price could extend its decline. Key support levels to watch include $93,000, $84,000, and $75,000.

The potential for a substantial recovery in Bitcoin's price from its current levels will likely depend on various factors, including the level of demand. For instance, while Bitcoin ETFs have contributed to selling pressure, discounted prices could potentially stimulate a resurgence in demand.

Recent heavy retail outflows align with the shift in sentiment favoring the bears. Nevertheless, some market data provides insights into emerging demand following the price dip.

Bitcoin Longs Make Significant Comeback

Whales typically play a crucial role in Bitcoin's recovery after substantial price dips. However, whale activity in October was relatively subdued, suggesting low confidence in an explosive Bitcoin price movement.

This subdued activity contributed to weak recoveries in recent weeks, paving the way for bearish capitulation. Analyzing whale activity is therefore essential for understanding the next potential market direction.

Data from Coinglass's large order book statistics revealed that whales executed approximately $2.2 billion worth of long positions on Binance and OKX over the past two days, indicating a bet on a recovery.

However, spot flow data indicated that whales acquired only about $6.79 million worth of BTC on OKX.

Binance and Coinbase, among other top exchanges, still accounted for approximately $87 million in spot outflows. This confirms that demand, especially among Bitcoin whales, has not yet fully materialized.

On the retail side, Bitcoin saw approximately $391 million in spot demand over the last 24 hours (Wednesday). This represents the second-highest daily spot inflow observed since the October crash.

These spot inflows over the last 24 hours contributed to the recent bounce back from the Bitcoin price support level just below $99,000.

Sustained buying pressure could fuel further recovery. However, weak spot demand from whales may once again suggest a limited recovery potential.