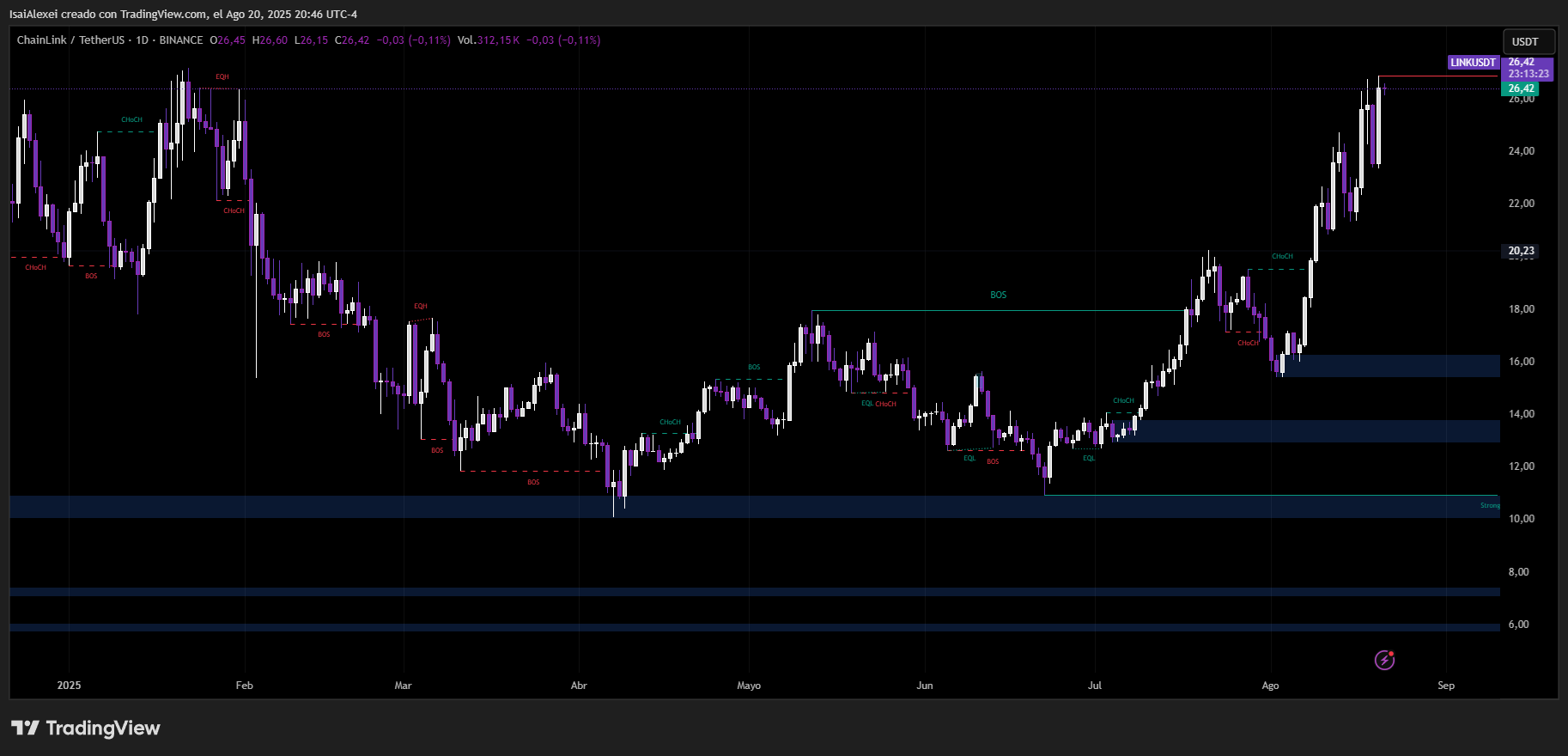

Chainlink (LINK) is trading at $26.35 USD, marking a +11.89% increase in the past 24 hours and showing 158.70% growth year-over-year. The price has surged over 36.6% in the last 30 days, reaching a 7-month high. Technical indicators reflect a neutral-to-bullish sentiment.

Source: LINK/Tradingview

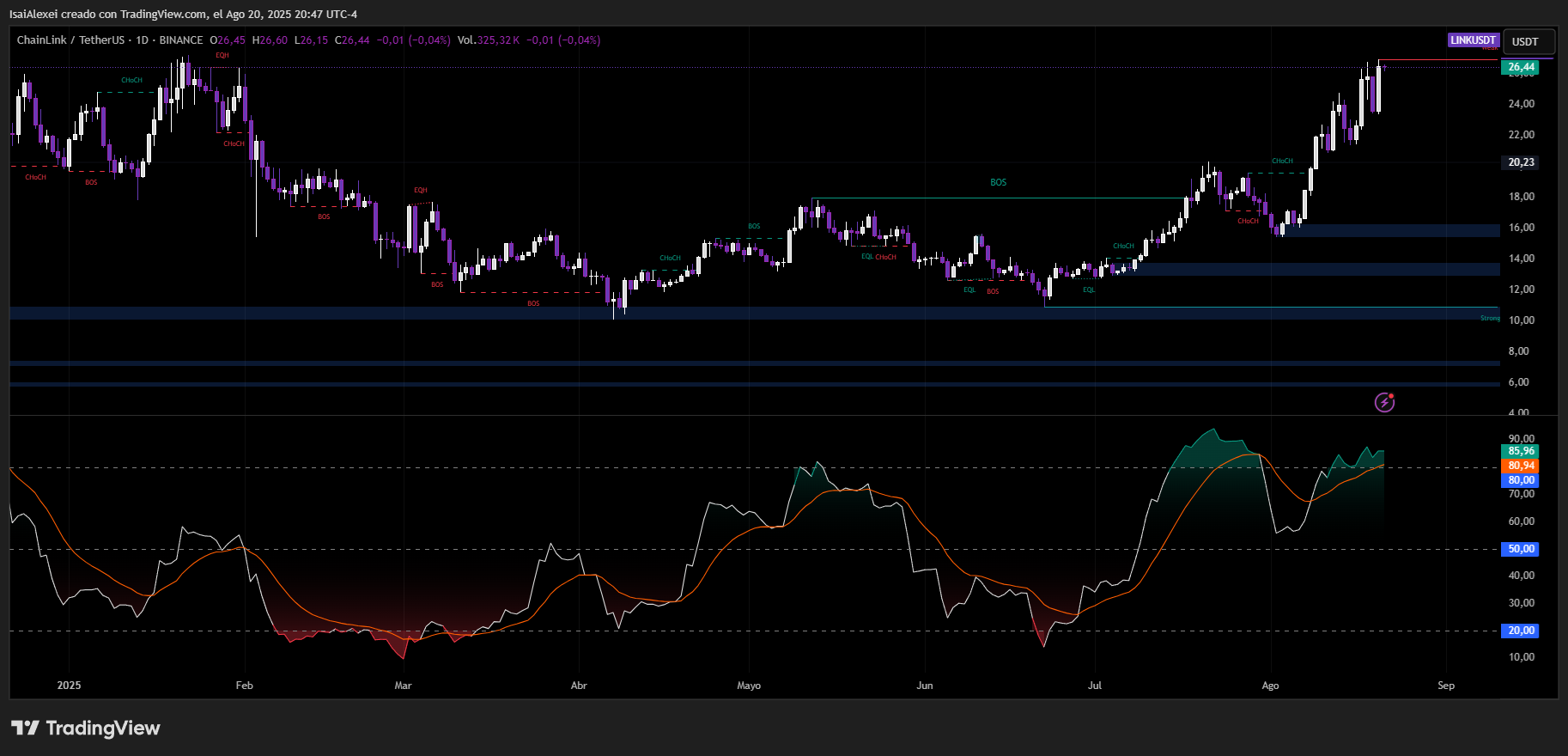

Source: LINK/Tradingview

The RSI is hovering in the upper zone, indicating strength but also suggesting potential overbought conditions. MACD remains positive, reinforcing bullish momentum, while trading volume continues at a robust $2.93B, reflecting strong interest and market participation.

Source: LINK/Tradingview

Source: LINK/Tradingview

Major support lies near the $24–$25 zone, and if sustained, LINK could target $28–$32 in the short term. A loss of this support may trigger a retracement toward $20–$21.

On August 13, 2025, the company announced collaborations with Swift and Euroclear to connect traditional payment systems with blockchains. Swift tested tokenized asset transfers with Chainlink and UBS Asset Management, enabling settlement across public and private networks.

Chainlink is also working with Citi and BNY Mellon on similar projects, while Euroclear is pairing artificial intelligence with Chainlink oracles to clean and route market data. BNP Paribas and Wellington Management are participating in these efforts.

The technical backbone is Chainlink’s oracle network and its Cross-Chain Interoperability Protocol (CCIP). Oracles deliver external data to on-chain applications. CCIP moves messages and value between chains. Banks use these tools to issue, settle, and reconcile tokenized instruments under existing operational controls. Fees for these services are paid in LINK, which ties network activity directly to the token.

LINK reached a seven-month high in August 2025 and now carries a market value above $16 billion. Developers building on Chainlink gain access to banks and market infrastructures that oversee large pools of assets. As a result, tokenized funds, deposits, and securities can be issued and settled with fewer intermediaries and clearer audit trails—a step closer to rails that feel both digital and familiar.

On-chain activity has been a major driver of the price surge. Within just two days, over 9,800 new addresses and 9,625 fresh wallets were created, suggesting explosive user interest and growing utility.

Over 80% of LINK’s supply is currently staked, creating a deflationary pressure that fuels further price appreciation. The network has expanded its real-world data feed integrations, particularly in tokenized assets and DeFi protocols.

Chainlink’s recent release of real-time data streams for U.S. equities and ETFs significantly boosts its relevance in traditional finance, enabling decentralized finance (DeFi) platforms to connect securely with traditional markets.

In terms of market mood, retail sentiment is 62% bullish, while institutional sentiment stands at 55% bullish, indicating widespread but cautious optimism. The Fear & Greed Index sits at 75 (Greed), implying strong buying interest but also signaling possible short-term overheating.

From a macro perspective, stable U.S. inflation (2.7%) and unemployment (4.1%), along with expectations of Federal Reserve rate cuts, create a favorable environment for continued crypto adoption.

Chainlink is increasingly recognized as a top Real World Asset (RWA) enabler and DeFi oracle provider. With its fundamental score at 82/100 and macro score at 78/100, LINK is strategically positioned in the crypto space, especially as it bridges on-chain and off-chain data infrastructures.

Source: LINK/Tradingview

Source: LINK/Tradingview

Given its historical volatility, future price targets range from $28 to $33 in the short-term, with long-term bullish targets around $43 to $63, and extended speculative patterns even eyeing $164–$192 based on Elliott Wave analyses.

The post Chainlink Teams With Swift and Euroclear to Link Banks and Blockchains appeared first on ETHNews.

By ETHNews.com

about 4 hours ago