On August 21, the Federal Reserve released the July meeting minutes, highlighting discussions on the impact of stablecoins following the GENIUS Act's passage in Washington D.C.

The GENIUS Act dictates new regulatory measures for stablecoin issuers, potentially driving greater demand for U.S. Treasury bonds and reshaping the financial landscape.

Federal Reserve officials have turned their attention to stablecoins after the passage of the GENIUS Act. The act, signed by President Trump, necessitates stablecoin issuers maintain reserves primarily in U.S. Treasury securities. This regulatory step marks a significant policy shift for digital currencies.

The act mandates high-quality liquid asset backing for stablecoins, which could increase demand for U.S. Treasuries. Experts anticipate that stablecoins will enhance payment efficiency and integrate more deeply into the financial system, posing potential disruption to traditional banking structures.

Market participants express varied responses. Jerome Powell has consistently advocated for stablecoin regulation, emphasizing their systemic importance. At the Wyoming Blockchain Symposium, Governor Waller highlighted stablecoins' potential to bolster cross-border payments and maintain the dollar’s global role. Industry leaders are watching closely for developments. As Jerome Powell stated, "Stablecoins have the potential to maintain and extend the role of the dollar internationally... also have the potential to improve retail and cross-border payments."

Did you know? The focus on stablecoins mirrors prior concerns raised post-UST collapse, emphasizing the need for stringent reserve criteria and systemic vigilance.

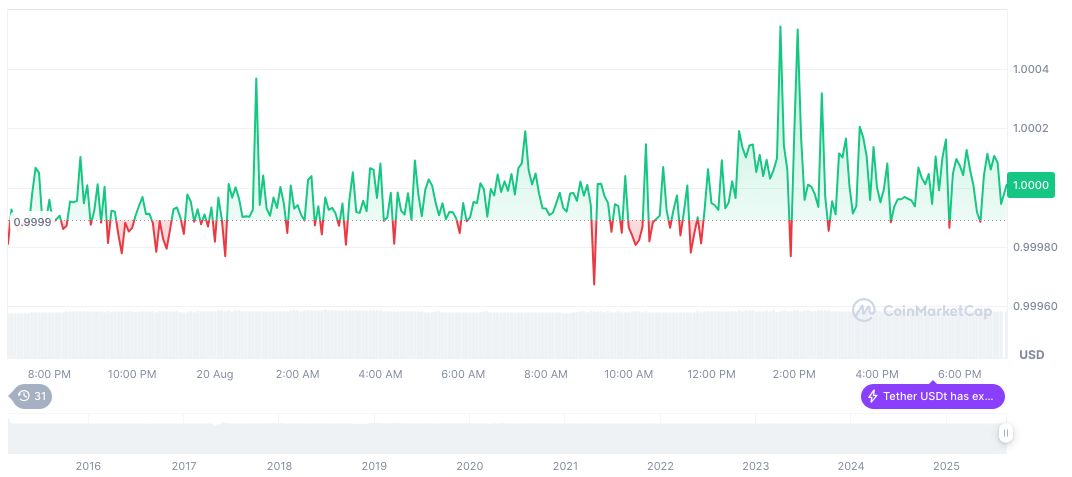

Tether USDt (USDT) remains at $1.00 with a market cap over 167021249186 dollars. Its 24-hour trading volume stands at approximately 127749447503 dollars, marking a decrease. Market cap dominance is 4.31%, while a steady price trend continues, per CoinMarketCap data.

Tether USDt(USDT), daily chart, screenshot on CoinMarketCap at 00:34 UTC on August 21, 2025. Source: CoinMarketCap

Tether USDt(USDT), daily chart, screenshot on CoinMarketCap at 00:34 UTC on August 21, 2025. Source: CoinMarketCap

Insights from Coincu research suggest that regulatory frameworks like the GENIUS Act could increase transparency and bolster trust in digital assets. Stablecoin adoption is likely to grow with enhanced legal clarity and institutional support, affecting global financial integration and infrastructure across digital ecosystems. For more insights, Governor Bowman stated this sentiment in a recent speech.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

By Coincu

about 6 hours ago