The Beijing Second Intermediate People's Court sentenced Liu to three years and six months in prison for concealing criminal proceeds through USDT transactions, emphasizing China's crackdown on crypto-related money laundering.

Liu's conviction underscores China's rigorous legal stance on virtual currency misuse, warning of severe penalties for financial improprieties facilitated through digital assets like USDT.

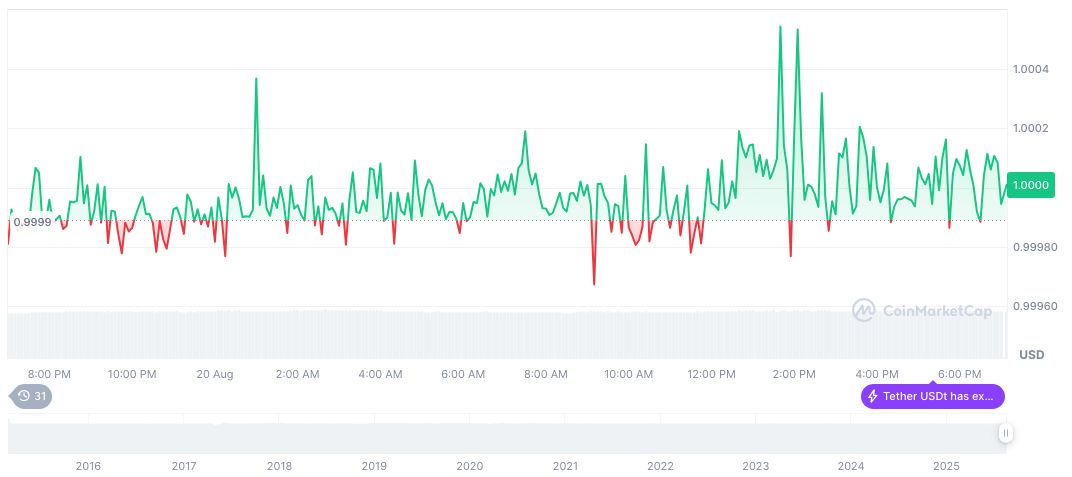

According to CoinMarketCap, Tether (USDT) holds a market cap of $167 billion and a 24-hour trading volume of $118 billion, marking an 11.37% decrease. Price fluctuations over 24 hours show a minimal decrease of -0.04%, reflecting its stable nature.

Coincu research indicates potential regulatory tightening in China, affecting cryptocurrency operations. Experts predict that China's measures could influence global conversations around stablecoin regulations, given the role of USDT in money laundering cases.

Did you know?

In 2023 alone, over 2,206 crypto-related fraud cases were reported in Beijing, involving over $60 billion. This trend highlights the persistent legal challenges faced by authorities in tackling crypto-based money laundering.

Did you know? Insert a historical or comparative fact related to this topic.

Market observers noted the case's impact on the heightened awareness of cryptocurrency's potential misuse. Although no public statements were made by industry leaders, analysts suggest increased caution in China's crypto community regarding illegal transaction involvement.

Tether USDt(USDT), daily chart, screenshot on CoinMarketCap at 13:34 UTC on August 21, 2025. Source: CoinMarketCap

Tether USDt(USDT), daily chart, screenshot on CoinMarketCap at 13:34 UTC on August 21, 2025. Source: CoinMarketCap

Following the ruling, Chinese authorities reiterated the severe legal consequences for assisting in laundering activities through digital currencies. They stressed that crypto could not shield illegal activities from law enforcement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

By Coincu

about 5 hours ago